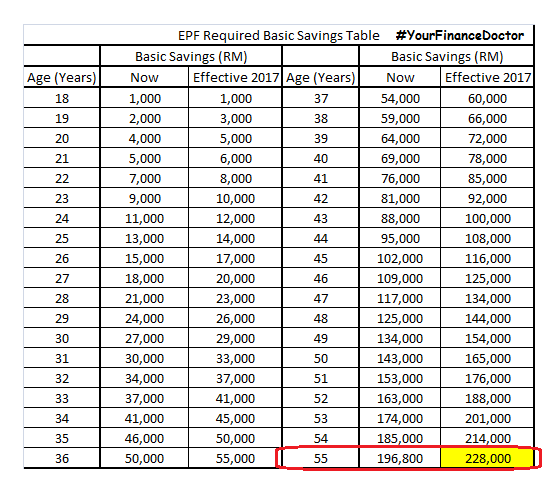

The Employees Provident Fund (EPF) has announced that the basic savings at age 55 will be increased from RM196,800 to RM228,000 effective Jan 1, 2017. The increment will also be made across all ages accordingly, refer to the table below.

What is Basic Savings?

The basic savings is a pre-determined amount set according to age in Account 1 to enable members achieve a minimum savings at different age, for example, when they reach age-55, they should have at least RM228,000 to retire. The amount in excess of the Basic Savings can also be invested in products offered by appointed Fund Management Institutions approved by the Ministry of Finance.

Why Do I Need That?

The rationale for the implementation of this basic savings is to ensure that members have sufficient savings when they retire in order to support their basic retirement needs for 20 years from age 55 to 75, in line with Malaysians' life expectancy. The new quantum is benchmarked against the minimum pension for public sector employees, which has been raised from RM820 to RM950 per month from age 55 to 75. (I don't think RM950 per month is enough either!)

How Does It Affects Me?

Well, it doesn't if you did not opt to withdraw for the Members Investment Scheme (MIS). But if you do, then the withdrawal amount for MIS will be reduced.

But thankfully, EPF also revises the Maximum Investment Withdrawal Percentage from the current 20% to 30%, effective Jan 1, 2017 as well.

Any Example?

As of today (30th July 2016), RM100,000 in Account 1:

As of 1st Jan 2017, RM100,000 in Account 1:

Conclusion:

With the increment in Minimum Basic Saving and Maximum Investment Withdrawal Percentage, members can now withdraw more money for investment. In other words, there will be more money available to be controlled by you. So if you think you can outperform EPF Dividend, then this will be a good news to you! Otherwise, it doesn't affects you at all.

To find out more about it, feel free to contact #YourFinanceDoctor at henrytcx@gmail.com

Don't forget to follow us on our Facebook Page too!

Earn, Save, Invest, Repeat!

Till then. Happy Investing! ;)

Subscribe to Your Finance Doctor by Email

Subscribe to Your Finance Doctor by Email

yeahhhh

ReplyDeleteThanks for reading! If you find it helpful, share with your friends too ya!

Delete