I first saw this article in Mandarin whereby the topic caught my attention. I supposed you are the same too to click into this post, after all, who does not want to learn from the Hong Kong billionaire right? Whether or not this is real from the master himself, we can always get something out of this inspirational five-year plan to improve one's life.

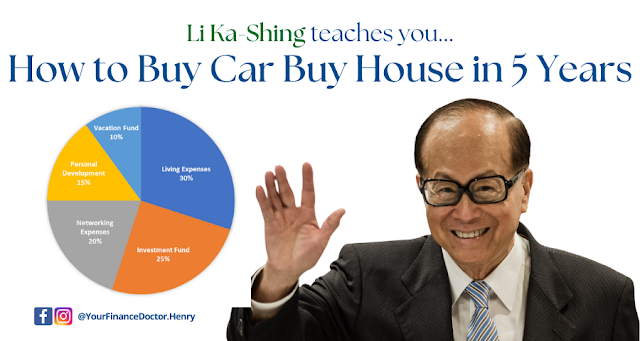

In the article, the assumption for your monthly income is only $2,000 when you just started out. He splits your money into five portions of funds according to the allocation of 30-25-20-15-10. The first portion $600 (30%), second portion $500 (25%), third portion $400 (20%), fourth portion $300 (15%) and lastly fifth portion $200 (10%).

Here are the direct translation then follow by my own interpretation, as Malaysian for Malaysian.

The first portion which is the biggest $600 at 30% - used for living expenses. It’s a simple way of living and you can only be assigned to less than twenty dollars a day. Eat simple. According to the article, when you are young, the body will not have too many problems for a few years with this way of living.

I supposed the article also assume that you stay with parents and probably use parents car too. But you get the gist of it, live minimally. You can only spend maximum of 30% of whatever you are earning and break it down into daily budget. If that 30% in monetary term is too low then you must get a part time job. Not just any job, but preferably sales job so that you learn the art of selling.

The second portion of funds - Investment. Save the $500 in your bank and accumulate it as your initial startup capital to do a small business. Go to wholesalers and look for products to sell. Even if you lose money, you will not lose too much money. However, when you start earning money, it will boost your confidence and courage and have a whole new learning experience of running a small business.

Earn more and you can then begin to buy long-term investment plans and get long-term security on your financial wealth being of yourself and your families. So that no matter what happens, there will be adequate funds and the quality of life will not decline.

I agree that a portion should always be allocated for saving/investment. A quarter of your salary can really help achieving your financial goals faster. As for the small business, I believe it is feasible too such as starting an online store in Shopee/Lazada/TikTok. You can even start with drop-shipping so that you can minimize the risk of stocks piling. In Malaysia, you can also start invest as low as RM100.

The third portion of funds - $400: To make friends, expand your interpersonal circle. This will make you well off. Your phone bills can be budgeted at $100. You can buy your friends 2 lunches a month, each at $150. Who should you buy lunch for? Always remember to buy lunch for people who are more knowledgeable than you, richer than you or people who have helped you in your career.

Make sure you do that every month. After one year, your circle of friends should have generated tremendous value for you. Your reputation, influence, added value will be clearly recognized. You’ll also enhance your image of being good and generous.

This purpose is not common in any standard budgeting methods but I have to agree it is important. It is also aligned with Warren Buffett's advice to "pick your friends wisely" and also Jim Rohn's famous quote - “You’re the average of the five people you spend the most time with.”

The fourth portion: $300 to learn. Monthly spend about $50 to $100 to buy books. Because you don’t have a lot of money, you should pay attention to learning. When you buy the books, read them carefully and learn the lessons and strategies that is being taught in the book. Each book, after reading them, put them into your own language to tell the stories. Sharing with others can improve your credibility and enhance the affinity.

Also save up $200 per month to attend a training course. When you have higher income or additional savings, try to participate in more advanced training. When you participate in good training, not only do you learn good knowledge, you also get to meet like-minded friends who are not easy to come by.

Most people rarely set a budget for this purpose but it is crucial regardless if is related to their career or not. I like how the article recommends to learn and share as I am a strong advocate of learning is not complete until you apply!

If you are working in any corporation in Malaysia, fully utilized the Human Resources Development Fund (HRDF) by attending trainings. After all your company is compulsory to pay 0.5% (5-9 Malaysian Employees) or 1% (10 and Above Malaysian Employees) of the monthly wages of each of their Malaysian employees. Psst! #YourFinanceDoctor provides HRDF Approved training courses too!

The last portion of funds $200: Use it for holidays overseas. Reward yourself by traveling at least once a year. Continue to grow from the experience of life. Stay in youth hostels to save cost. In a few years you would have travelled to many countries and have different experiences. Use that experience to recharge yourself so that you’ll continually have passion in your work.

This is the one expense that financial advisor does not need to ask you to add as you would have already done so! I would say that most people, youngsters in particular, could have overspend on vacation. So yeah, keep it below 10%! If you are envious of your friends' overseas travel, then learn to increase income first.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The article continue to go on and on which I find it way too long so I will just pick some for you.

"Well, after struggling for a year and if your second year salary is still $2,000, then that means you have not grown as a person. You should be really ashamed of yourself. Do yourself a favour and go to the supermarket and buy the hardest tofu. Take it and smash it on your head because you deserve that."

🙊 That is a bit dramatic, but you get the point. You should be better than yourself from last year.

Try to buy minimal clothes and shoes. You can buy them all you want when you’re rich. Save your money and buy some gift for your loved ones and tell them your plans and your financial goals. Tell them why you are so thrifty. Tell them your efforts, direction and your dreams.

👍 Yes, people around you may not understand so communication is key!

Life can be designed. Career can be planned. Happiness can be prepared. You should start planning now. When you are poor, spend less time at home and more time outside. When you are rich, stay at home more and less outside. This is the art of living. When you are poor, spend money on others. When you’re rich, spend money on yourself. Many people are doing the opposite.

👆 Start with planning and get it started.

There is nothing wrong with being young. You do not need to be afraid of being poor. You need to know how to invest in yourself and increase your wisdom and stature. You need to know what is important in life and what is worth investing in. You also need to know what you should avoid and not spend your money on. This is the essence of discipline. Try to avoid spending money on clothing, but buy a selective number of items that have class. Try to eat less outside.

👌 On point!

Famous theory from Harvard: The difference of a person’s fate is decided from what a person spends in his free time between 20:00 to 22:00 . Use these two hours to learn, think and participate in meaningful lectures or discussion. If you persist for several years, success will come knocking on your doors.

✋ The article continue endlessly beyond this, which I will stop here as I find it irrelevant to the main topic of budget allocation. It looks like someone just copy all the famous lessons on the internet and just dump it all at the end of the article.

There are many people who are struggling to make ends meet. It doesn’t matter if you are rich or poor. There are lessons for all to learn from Li Ka-Shing. In case you have not notice, I am also applying the teaching of Li Ka-Shing -- sharing with you all what I learned!

梳理心得不错,有学到哦~ 谢谢分享 伊菱

ReplyDelete