I came across one of the top trending articles from CNBC where it says 65% of Americans are doing the exact opposite of what they’re supposed to. Although I do not have the exact percentage for Malaysians but I supposed it applies to everyone and I thought it is interesting to share with you too.

The author used a good analogy to demonstrate the case, so I will keep it simple for you here as well. Imagine if iPhone 14 Pro Max is having 14% DISCOUNT (the actual release date will be end of this year, most probably Sep 2022!), would you buy it right now?

Most likely you will. Even if you are not Apple fan and you don't plan to use it yourself, you can easily sell it right? After all, it is the pleasure of getting something cheap. Psychologically, discount creates urgency as well as the fear of missing out (FOMO). This applies to everything else, such as airplane tickets, hotel discount and all sort of promotion that you frequently found on your social media. When there's discount, you are most likely to buy.

Unfortunately, that is not the case when it comes to stock market. You may not be as enthusiastic about the markdown on stocks. As of 1st Aug 2022, S&P500 year to date is down about 14%. Not just S&P500, NASDAQ -21%, EURO STOXX 50 -15%, HSI -15%, KLCI -5%. But will you be buying (investing) at cheaper price now?? Probably not.

So according to the article, 65% of the Americans say they are keeping money out of the market due to fear of investment losses. I do not have the figure for Malaysians, but most likely you might be the same too. If I am wrong about you, then let me know in the comment down below! 😏

Isn't it amazing on how our mind works? That when it comes to stock market, most people see it as a drop (hence fear of loss) but not as a discount? You may say that what if market drops further? If is so, shouldn't you be worried that iPhone 14 Pro Max will drop further too? You see all we have to do is just to tweak our mindset!

Psst! On a side note... do you know Apple stock price down by 11.26% year to date too? You can buy 6 shares ($972) now with the price of 1 iPhone 13 Pro Max ($1099). So why not 6 Apple Shares? Being a shareholder (even just a tiny) of Apple Inc certainly deserves the bragging right more than owning 1 iPhone 13 Pro Max (which soon will be outdated when 14 is out) right? 🤔

.png)

It is normal to be fearful when the market is in red, we are human after all. So you may be thinking perhaps to wait for the bottom, which people always try to do - to time the market. But unless you have a crystal ball (yes even Warren Buffett cannot tell you when will bottom), otherwise it is always best to stay invested, not fully and not all in, just stay invested.

Don't believe me? Look at the study from JP Morgan, if you missed out 10 best days from a 20 year period, your Annualized Return dropped from 9.52% to 5.33%! Most people adopt the "KIV" (Keep In View) approach, but usually they ended up buying at high or selling at low already. Then there's where they got burnt and just make a conclusion to others that stock market cannot earn money!

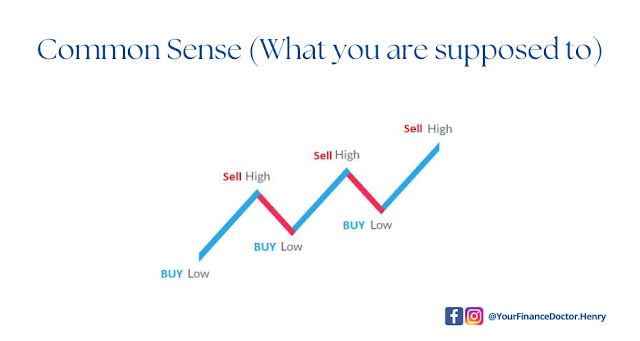

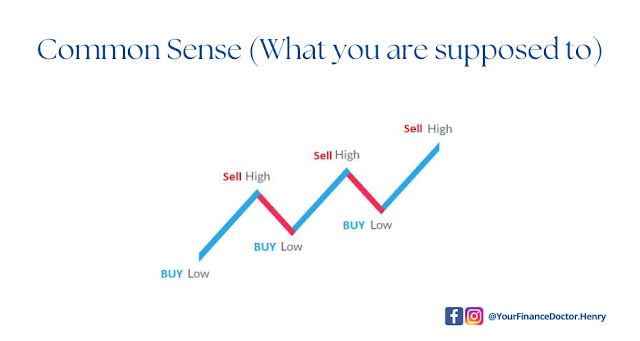

I remember there is a saying like when you hear the taxi driver or the most unlikely person to be investing, to talk about investing in share market, then maybe it is time for you to sell and run far far away! Trust me, too late to enter by then. No offence to the taxi driver or the 小白 friend, but these people usually ended up BUY HIGH because of GREED and SELL LOW because of FEAR.

So we have to be disciplined, be conscious and stay RATIONAL, which I think it is the utmost important one, not just to stay invested but to invest consistently through down markets. Nobody likes the feeling of seeing big red numbers in their portfolio, but if you are invested in a well diversified portfolio for a mid to long term financial goal, you really do not have to worry at all.

Treat the investment like your favorite brands, you will want the price to go down so that you can buy at low price. Adopt cost averaging strategy, where you invest in a consistent intervals, buy more shares when they are cheaper and fewer when they’re more expensive.

If you read until this part and still isn't convince to invest now, then you must be really conservative.

Fret not, if you...

- Do not know what stocks to invest and do not have the time to research and manage

- Do not have the discipline to invest by yourself

- Sick of looking at your big red negative numbers in your portfolio

- High allocation in MYR and want to diversify some to USD

- Participate in S&P500 stock market growth without downside risk (principal protected)

- 310USD per month (RM1400 per month) is affordable to you

Prefer to invest in MYR? No worry, I've got you covered too!

As Licensed Financial Advisor, we have solutions for your every needs.

Most importantly, you are making a well informed decision.

.png)

.png)

No comments:

Post a Comment

Feel free to comment! Thank you!