What is Hindsight Bias?

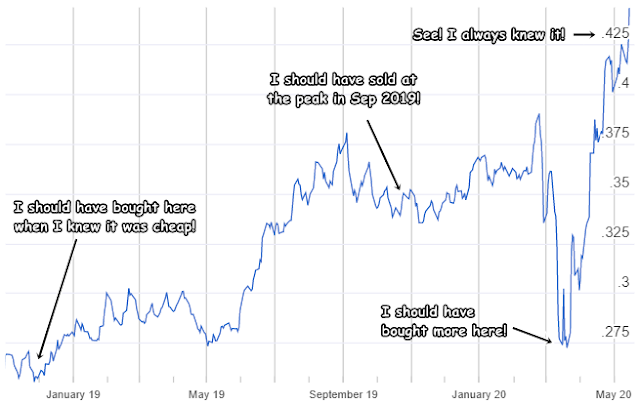

Hindsight bias is the tendency of investors to falsely believe that they predicted the outcome since the beginning, only after learning the outcome. The most common phrases would be "I knew it all along" and all the "should have" and "could have".

|

| Hindsight Bias |

Implication of Hindsight Bias?

In Behavioral Finance, this is one of the most common financial biases every investors would make unknowingly, which may leads to overconfident. This in turn causes them to take more unnecessary risks and trade more than they otherwise would.

How to Avoid Hindsight Bias?

To avoid Hindsight Bias, just follow the 4 simple steps!

- Acknowledge and be conscious that everyone is vulnerable to the bias

- Keep an Investment Diary

- Record the reasoning behind all the financial decisions in the diary

- Map the outcomes to the reasons and learn from both the wins and losses

It is utterly important to know, not just what happens, but why it happens regardless if is a win or a lose. With a record of all the reasoning, win can be repeated and loss can be avoided in the future. That is the best way to learn from the past, instead of relying on our biased mind. Which is why Warren Buffet always warned about investors not learning from the past in one of his favorite quote.

Stay tuned for other financial biases that we commonly made in the upcoming posts! Remember to Like, Comment and Share @YourFinanceDoctor.Henry if you find it useful!

No comments:

Post a Comment

Feel free to comment! Thank you!