Following the well response from the previous FAQ post on how #YourFinanceDoctor charges in Unit Trust Investment (read here if you haven't), I have decided to write on this first before the "Why Your Agent Does Not Find You Anymore?". So as usual, here's the question:

Prospect Teoh: "Any fund outperforms 6.4%?"

Answer:

YES OF COURSE! But first let me go through some introduction to Unit Trust. Unit trust fund may not be well known enough in Malaysia as compared to other countries due to the lack of financial literacy among Malaysians. As of 31 July 2016, statistic from Securities Commission Malaysia has shown that there are a total of 636 approved funds from 35 management companies which amounted to RM352 billion of total net asset value (21% of Bursa Malaysia Market Capitalization).

|

| Captured from Securities Commission Malaysia website |

So the question is, are you aware that there are a total of 636 funds from 35 different management companies for you to choose from? Probably not! Most of the people #YourFinanceDoctor came across only know a few of them which are well known (company with strong marketing) such as Public Mutual and probably a few others like CIMB or RHB. Hence it is normal to jump into conclusion that unit trust doesn't perform well when you are not expose to all the available funds.

Instead of telling you what are the Top Funds with Highest Return, here's how you can learn to fish for yourself! ;)

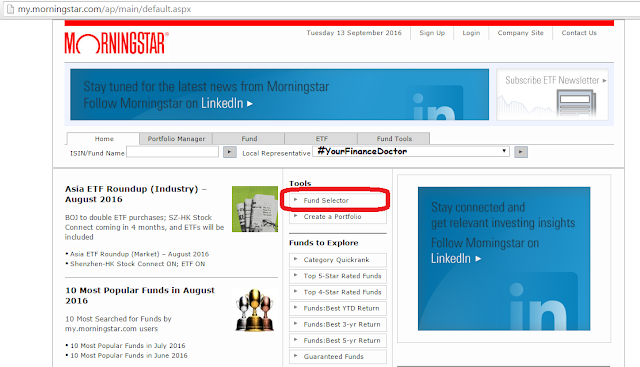

Step 1: Go to www.my.morningstar.com/ap/main/default.aspx and Click "Fund Selector"

FYI, Morningstar, Inc. is a leading provider of independent investment research in North America, Europe, Australia, and Asia. Take note that it is important to go for independent website to get unbiased/neutral data.

(Ads: Just like you should hire Independent Financial Advisor like #YourFinanceDoctor !)

Step 2: Click "Search" to see all the available funds in Malaysia

When you are familiar with the website, you can then play around with the filters like sort the funds by categories such as fund type, base currency, local representative, investment provider and so on!

Step 3: Click on "Performance" tab and Click "10 Years Annualized(MYR,%)" to sort

Don't be overwhelmed by the long list of funds! Good thing about this website is that you can get all sort of information of the funds. So sorting by 10 Years Annualized Return will give you a list from highest to lowest. As you may see, Kenanga Growth Fund, Eastspring Investments Small-cap and Affin Hwang Select Asia (ex Jpn) Quantum are the top 3 funds. Their return? Easily more than 6.4%!

Step 4: 10 Years too long? Click 5 Years Annualized then!

Step 5: 5 Years is still too long? Click 1 Year Return then!

Upon this step, you may realized that why in short term the return could be as high as 69%?! Well the truth is anyone in the market can tell you how good they are to earn 2 or even 3 figure return in percentage. But how many of them can continuously and consistently doing that? RARE! So same goes to unit trust fund, you may required to do research on each funds.

(Ads: That's why you pay #YourFinanceDoctor to do all the hard work!)

But back to answer to the question, YES OF COURSE there are plenty of funds outperform 6.4%! A quick sort on 1 Year Return from Largest to Smallest, you will see that the outperforming funds stop at Affin Hwang Select AUD Income with a 1 year return of 6.43%! Take note that it is on page 9, so with 30 funds per page, that will be [(9 x 30) - 13] = 257 funds outperform 6.4%! Which means, out of 670 funds, 257 funds or equivalent to 38% of chances that you will earn more than 6.4%!

And if we want to see which funds consistently outperform 6.4%, then let's sort by 10 Years Annualized Return Largest to Smallest. Again as you can see, it stops at Public Asia Ittikal with 6.43% 10 Years Annualized Return on page 5. So that will be [(5 x 30) - 14] = 136 funds outperform 6.4%! However, out of 670 funds, there are only 277 funds that are existed for more than 10 years. So that means out of 277 funds, 136 funds or 49% of chances that you will earn more than 6.4%!

P/S: Do take note that funds that are approved for EPF Withdrawal for Investment will be much lesser (Please refer here for more info)

Example:

Take example of the top fund in the list of 10 Years Annualized Return, Kenanga Growth Fund. If you have invested a once-off lump sum of RM10,000 in 15th September 2006 (10 years ago), with 10 years Annualized Return of 17%, you will now have RM48,533.92! (Yes without doing anything!)

RM10,000 -> RM48,533 (10 years in KGF)

RM10,000 -> RM14,802 (10 years in Bank FD)

|

| Chart taken from Morningstar! |

So you see, this is why, again and again, #YourFinanceDoctor would urge all of you to start investing! One question that you should always ask yourself...

Yes you may be hardworking,

But is your money hardworking than you?

|

| Slide taken from one of #YourFinanceDoctor talk |

Disclaimer:

Do take note that all the above does not indicate any recommendation to buy. You are advised to do your research before investing into any particular funds. Otherwise, you should get a Independent Financial Advisor like #YourFinanceDoctor (Contact me here!)

That's all for now, Happy Investing!

Coming up next, "Why your Agent does not find you anymore?" Stay tuned for the next post!

If you have any question to ask #YourFinanceDoctor, feel free to email here.

wow! thnks for this info

ReplyDeleteglad that it helps!

DeleteWow, I don't know we can get information like this just through the website. Though this is good to get this kind of information on website, I think it is still better we get it directly from a financial advisor because some of the terms in the website we might not understand

ReplyDeleteyes, just like you can search all the remedies to cure a sickness from internet, but when it comes to serious one you still need to see a doctor.

DeleteFor a normal people who haven't basic Knowledge about UT, i think they might have difficulty to understand all these. The best way is to seek for the expert to give full explanation and guide step by step. But for people who love to make an investment, this article would be benefit to them.

ReplyDeleteyup.. should do some research before investing the money..

ReplyDeleteMust learn about unit trust or do some research before invest..need help from financial advisor too if im not mistaken.. correct me if i'm wrong ya..

ReplyDeleteThere are so many things need to be learn when it comes to investing. I am glad to found this blog for guidance. Thank you for the info !

ReplyDeleteYes, i only knew the popular one only. Never knew there are 600+ more active Unit Trust Fund. Thank you for sharing these.

ReplyDeletegood info... and good sharing to...

ReplyDeletethanks for the info i might refer to you if i need your help regarding bout the fund..

ReplyDeletethis article is good for people who love to make an investment.. huhu.. honestly i have zero Knowledge about UT ..

ReplyDeleteSounds like a good investment instrumet.. Really worth investing into

ReplyDeleteThanks for the info. Really need to study this over.

ReplyDeletewah membaca artikel ini jadi banyak belakjar

ReplyDeleteNice sharing! Will refer to your blog if I want to do investment in future

ReplyDeleteThis is such a good share. More people should read to know more in depth info about this.

ReplyDelete