When it comes to Unit Trust Funds, what is your common perception towards the return? Well, most people would have different answer depending on their personal past experience. Given to the wrong hand of those bad apples will surely yields you a bad return with your hard earned money. So, are you getting the best funds from the market?

|

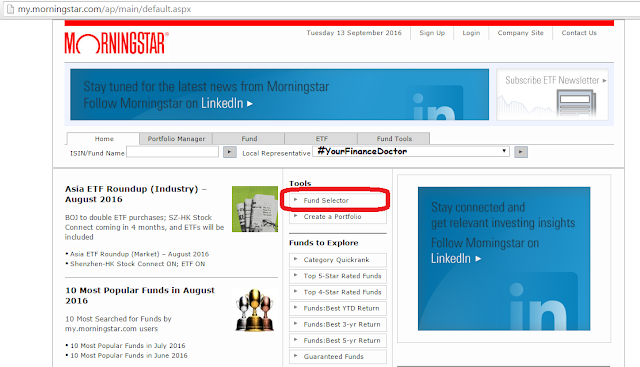

| Table from Morningstar |

Let's take a look at the 5 Best Performing Unit Trust Funds over the past 10 years out of 540 funds available in Malaysia. You can invest into any of it with minimum of RM1,000, some can even start as low as RM100!

Affin Hwang Select Asia (Ex-Japan) Quantum Fund (AHSAQF) seeks to achieve consistent capital appreciation over medium to long-term by investing mainly in growth companies in Asia with market capitalization of not more than USD 1.5 billion at the time of acquisition. The fund has a 10-Year annualized return of 15.32%. However it is currently soft-closing as it almost reaches the maximum fund size, so cash investment is no longer available, but you may still invest in it using EPF Withdrawal.

Kenanga Growth Fund (KGF) aims to provide Unit Holders with long-term capital growth by invest principally in a diversified portfolio of equity and equity-related securities in Malaysia. Lee Sook Yee is the fund manager as well as the Chief Investment Officer (CIO) since 2013, bringing with her more than twelve (12) years of experience in local and regional equities investment. The fund has a 10-Year annualized return of 14.51%. You can start investing in it as low as RM100!

Eastspring Investments Small-cap Fund (EISCF) targets to provide investors with maximum capital appreciation by investing principally in small market capitalization up to RM3 billion at the point of acquisition companies in Malaysia which will appreciate in value. The fund led by Chen Fan Fai, where the team continue to adopt a bottoms-up approach in selecting stocks where they prefer stocks with healthy earnings growth and strong balance sheet. The fund has a 10-Year annualized return of 14.02%. However, it is no longer available to invest as it reaches the maximum fund size limit.

Manulife Investment Progress Fund (MIPF) strives to provide Unit Holders with steady long-term capital growth at a reasonable level of risk by investing in a diversified portfolio of small- to medium-sized public listed companies in Malaysia. Nicholas Tiong is the fund manager since 2002. The fund has a 10-Year annualized return of 12.26%.

Public Smallcap Fund (PSCF) works to achieve high capital growth through investments in companies with market capitalization of RM1.25 billion and below with special focus on growth stocks. To achieve increased diversification, the fund may invest in foreign markets. The fund may also invest in fixed income securities to generate additional returns. The fund has a 10-Year annualized return of 12.16%. However, it is no longer available to invest as it reaches the maximum fund size limit.

***Noteworthy - KAF Vision Fund (KVF)'s investment objective is to provide Unit holders with medium to long-term capital growth with a mixture of maximum 65% of the Fund’s NAV will be invested in smaller capitalized companies not exceeding RM1 billion at the time of purchase and maximum 30% of the Fund’s NAV in larger capitalized companies exceeding RM1 billion at the time of purchase. The fund has a 10-Year annualized return of 10.46%.

Did you invest any of these?

Conclusion:

Take note that the only 4 funds, namely AHSAQF, KGF, EISC and KVF managed to get DOUBLE-FIGURE annualized return for all 10-year, 5-year, 3-year, 1-year and even Year-To-Date! Although past performance does not guarantee the future return, but judging from the past performance of the fund, one can tell how good is the fund manager in their investment approach, stock selection methodology and even how efficient is the fund manager utilizing the pool of funds from investors. (provided that there is no change in management)

Anyway, this post is just to show that Unit Trust Fund can yields high return as well (does not indicate any buy recommendation), provided that you have done your research and analysis on which fund to invest in. If the fund recommended by your agent is still not performing after a long period, the reason can only be one - your agent is not managing for you! Time to hire #YourFinanceDoctor!