As you may know in the recent Budget 2016 re-calibration, our Prime Minister has announced the reduction of Employee Provident Fund (EPF) Employee Contribution from 11% to 8%. However, members are given the option to remain their contribution at 11% by filling in form and submit to their employers. So here comes the golden question....

EPF Employee Contribution : 11% or 8%?

First, let's take a look on what's the difference.

For instance, a person with RM3,000 monthly gross salary, he would have RM90 more every month for his take home salary. So it's quite straightforward to calculate how much exactly you will get to bring home more instead of going into EPF!

So what are the Good Things about it?

1. You got extra money to spend!

YES! There's nothing better than having more money to spend! There are so many things you could do with that extra 3%! Especially with the advancing of technology, this is the era where the world is full of temptation!

2. You can be a really good citizen!

You could help to spur the growth of Malaysia by being part of the estimated RM8 billion increase in private sector spending! By spending on items that subjected to GST, you will also contribute to the government revenue too!

3. You can be a REALLY-REALLY good citizen!

Apart from all the above, you could also further contribute to the government thru the extra income tax that you have to pay. Logically, tax relief on EPF part would be reduced (if there's no sufficient life insurance to cover) and hence, higher chargeable income to be taxed. Take a look at the following table.

Assuming only Individual relief (RM9,000) and EPF & Life Insurance relief (RM6,000) are taken into calculation with no other tax relief:

As you may see from above, if you opt for the 8% EPF contribution, your payable income tax will be increased too, but this is only applicable for those annual income within the affected range which is roughly above RM36,000 to below RM75,000. Above that, your income tax makes no difference with or without the 3% reduction as your tax relief for EPF portion has reached maximum of RM6,000.

***Do take note***

As highlighted yellow in the table, if your chargeable income to be taxed is around RM35,000, then congratulation, you are the TOP CONTRIBUTOR as the tax difference can be as much as RM400 and above! This is due to the fact that, after the drop in claimable tax relief for EPF, you are not entitled to the Tax Rebate of RM400 (chargeable income lesser than RM35,000) .

What about the bad thing?

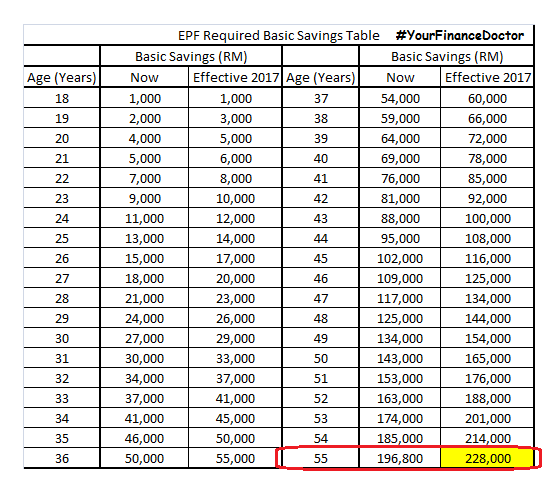

1. You will have lesser retirement fund in your EPF!

Since this will only be started from March 2016 to December 2017 which is 22 months, the 3% reduction in EPF will turn into a value of around RM2,800 in 2018 and almost RM16,000 after 30 years! The estimated value is calculated based on the assumption of average 6% annual dividend throughout the years.

Conclusion

I believe after reading all the above, you should sense the sarcasm of #YourFinanceDoctor. But, back to the question again, 11% or 8%? But honestly, if you asked #YourFinanceDoctor, the answer is really depending on each individual. But here are the option for different types of people:

For Employees with no self-control but is concern about it :

Beginning Feb 2, download the form from

EPF Website (Bookmark it!), fill it up and submit to your employers. Once your money is in EPF, you won't be able to take it out to spend until you are retired.

For Employees with self-control :

You may opt to:

1. Pay down your debt (starting with high interest ones!)

2. Pile up your emergency fund (at least 3 months of expense)

4. Buy Life Insurance to max out on tax relief for EPF/Life Insurance (up to RM6,000).

Whatever it is, seriously, don't bother to put it in bank, as that will be the most stupid-est thing to do!

For Employees who don't give a shit :

Just take it and spend it! Malaysia is proud of you! We are proud of you! :D

(Probably you won't be reading in here too.)

For Self-Employed without EPF (just like #YourFinanceDoctor) :

There's nothing you need to do! Unless if you would like to contribute in

EPF-1MRSS!